Understanding Amortized Bonds

Nov 15, 2023 By Rick Novak

In an amortized bond, the principal is gradually lowered. Scheduled payments gradually reduce debt. Amortized bonds are unique because investors get interested in a part of the principal in each payment. This method shows investors how the bond's value declines over time, ensuring a predictable return. Amortized bonds provide regular interest payments and a gradual principal reduction. Amortized bonds use a more complex rate of return than ordinary bonds. A continuous and predictable cash flow during the bond's tenure makes this structure ideal for long-term projects.

Amortized bonds provide issuers and investors financial flexibility. These bonds allow issuers to acquire long-term borrowing and better manage cash flows. However, investors desire security in their portfolios and are drawn to amortized bonds by their regular income source. The delicate dance between debt repayment and interest payments underpins these bonds, which we'll examine presently.

How Amortized Bonds Work

Principal Repayment:

At the core of an amortized bond is the regular decrease of the principal amount throughout its life. Unlike this progressive repayment arrangement, traditional bonds typically require a lump-sum principal repayment at maturity. Amortization reduces the danger of significant, one-time payments and promotes financial sustainability.

Interest Payments:

The monthly interest payments provided to bondholders are essential to the operation of amortized bonds. Based on the remaining principal, these payments decrease. Interest due falls with the principal, lowering interest expenditure. This distinctive trait correlates with financial prudence and makes amortized bonds appealing to investors seeking a more predictable income stream.

Relationship with Time:

Timing is crucial in the financial environment and significantly impacts amortized bonds' dynamics. Time and payments affect issuers' and investors' cash flows. Financial planners must understand this temporal link to negotiate amortized bonds with wisdom and foresight.

Critical Components of Amortized Bonds

Face Value:

Face Value: The face value of an amortized bond is its original value upon issuance. Investors may calculate interest payments and projected returns using this nominal value. Face value is the bond's financial foundation, affecting cash flow dynamics.

Interest Rate:

Bondholders get monthly interest payments based on the interest rate, fixed at the time of issue. This rate determines the magnitude of these payments, which affects the bond's investor appeal. Investors evaluating amortized bonds look for a balance between competitive yields and risk mitigation in the interest rate.

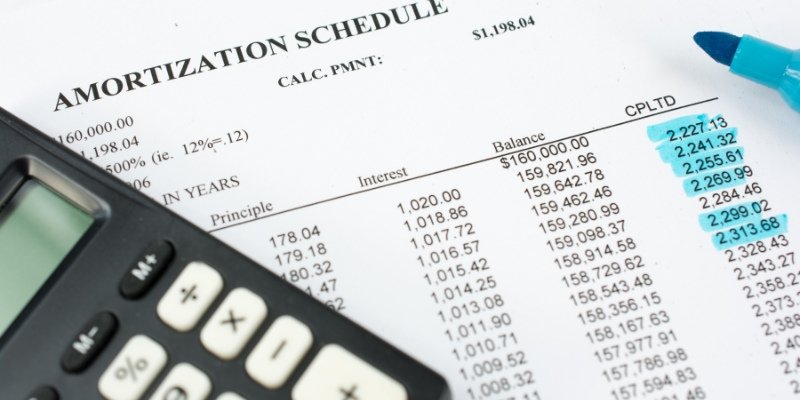

Amortization Schedule:

The amortization schedule guides the repayment of the bond's principal during its lifetime. This schedule breaks principal payments into manageable installments, giving issuers and investors a plan to reduce liability gradually. The amortization schedule's careful design provides a smooth financial journey for all parties.

By navigating these essential components, stakeholders may make educated choices based on their financial objectives and risk appetite. Issuers may arrange bonds to meet their financing and financial goals, while investors can evaluate the bond's attractiveness. Amortized bonds produce a transparent, predictable, and adaptable financial environment.

Advantages of Amortized Bonds

Predictable Cash Flow:

Predictable Cash Flow: Amortized bonds benefit from predictable cash flow. The periodic repayment of debt and fall in interest payments provide investors with consistent revenue. This predictability helps income-focused investors fulfill their financial goals with regular returns. The certainty of a constant cash flow helps investors plan and manage resources, making amortized bonds more appealing in the broad investing environment.

Reduced Interest Rate Risk:

Reduced Interest Rate Risk: Amortized bonds protect against interest rate volatility. As the principle decreases, so do interest payments, lowering interest costs. This unique feature reduces interest rate swings' influence on bond returns. Amortized bonds provide market protection, making them a good alternative for investors looking to reduce interest rate risk.

Accounting Benefits:

Amortized bonds correspond with accrual accounting rules and give particular accounting advantages. The methodical acknowledgment of costs and earnings matches the steady principal reduction. Transparency in financial reporting improves issuer and investor financial health and performance assessments. Amortized bonds provide a more complete and informative financial picture, helping sound decision-making.

Risks and Considerations

Interest Rate Fluctuations:

Despite their advantages, amortized bonds are not immune to risks. Interest rate fluctuations pose a substantial risk, impacting the bond's value in the secondary market and the overall returns for investors. Issuers and investors must remain vigilant, employing risk management strategies to navigate the ever-shifting landscape of interest rates and their potential effects on bond performance.

Market Conditions:

The performance of amortized bonds is intricately woven into the fabric of market conditions. Economic factors, credit conditions, and investor sentiment collectively influence the bond's value and attractiveness. A dynamic understanding of the broader market context is imperative for investors and issuers to make informed decisions. Thorough due diligence, continuous monitoring of market conditions, and an adaptive mindset are essential to successfully navigating the challenges of fluctuating market dynamics.

Impact on Investors:

Amortized bond investors must consider how interest rate changes and market circumstances affect returns. Optimizing investment portfolios requires proactive risk management, diversification, and market awareness. Investors may make educated choices that match their financial objectives and risk tolerance by knowing risks and market context.

Examples of Amortized Bonds

Illustrative Case Studies:

These case studies demonstrate the functionality of amortized bonds in various contexts. Case studies allow stakeholders to see issuers' effective practices. Current and prospective bondholders may benefit from understanding how amortized bonds are designed to satisfy financing requirements and manage risks.

Real-world Applications:

Real-world instances demonstrate the applicability of amortized bonds across many sectors and businesses rather than only theoretical talks. These applications demonstrate how this financial instrument is used. Stakeholders learn about amortized bonds' adaptability and efficacy by studying their critical roles. These cases turn theory into practice, giving stakeholders valuable insights. Understanding amortized bonds better than others helps people apply this information to financial situations.

Conclusion:

Amortized bonds are flexible in the changing financial world. This examination reveals the issuer-investor relationship and the financial instruments' purpose and function. An amortized bond deviates from the standard by gradually reducing principal and interest. This unique structure provides stability, predictability, and financial sustainability for stakeholders. Face value, interest rate, and amortization schedule create a complex financial web that defines amortized bonds.

Investors contemplating amortized bonds must weigh the pros and drawbacks. While tempted by predictable cash flow, decreased interest rate risk, and accounting advantages, companies must consider interest rate volatility and market circumstances. An educated and proactive risk management strategy guides investors through financial complexity. Issuers must strategically structure amortized bonds to meet financing and financial goals. Market adaptation comes with the promise of consistent cash flow and lower interest rate risk. Long-term financial sustainability requires a bond issuance plan that maximizes rewards and manages risks.

Rick Novak Nov 15, 2023

Kelly Walker Nov 15, 2023

Rick Novak Nov 16, 2023

Rick Novak Nov 15, 2023

Rick Novak Nov 15, 2023

Rick Novak Nov 14, 2023